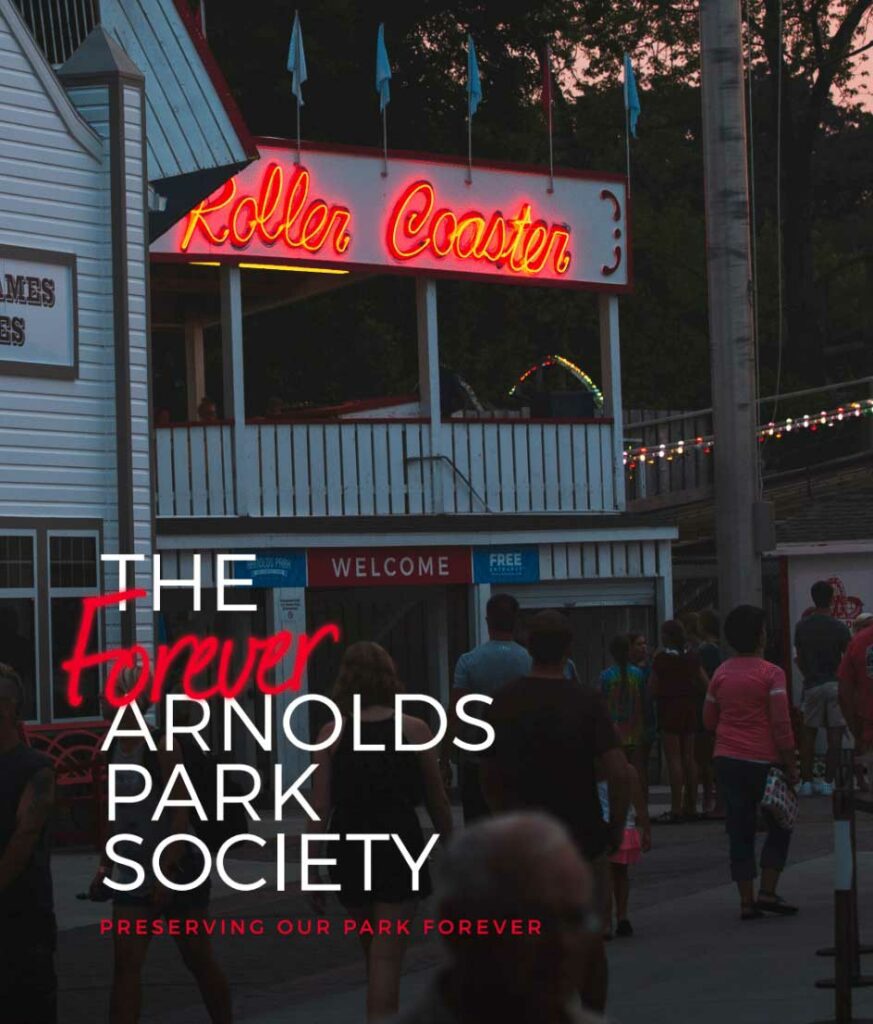

A new gift society designed to provide resources for the Park in perpetuity has been formed at Arnolds Park Amusement Park.

The “Forever Arnolds Park Society” will allow individuals and families the opportunity to leave a lasting legacy by including the Park as a beneficiary of their estate plans.

Donors may obtain membership in the Society through written confirmation of a planned gift arrangement. Bequests are the most common form of planned gifts where donors include language in their last will and testament that directs a specific asset, total dollar amount or percentage of the residual estate to Historic Arnolds Park, Inc.

Other qualifying gifts include naming the Park as a beneficiary of an IRA, 401(k), Keough or other retirement plan, life insurance policy, trust, or life income arrangements.

Realized planned gifts are generally designated to the Arnolds Park Endowment Fund, a permanent endowment fund established more than a decade ago. Annual earnings from the endowment provide capital for new park attractions, ongoing operational and maintenance support, park beautification, enhancements to the Queen II, and resources for greatest needs. Planned gift donors may also designate their future gift to benefit a specific program or area at Arnolds Park.

By joining the Forever Arnolds Park Society, you affirm the mission and vision of Historic Arnolds Park and provide needed future resources to sustain, advance and ensure the Park experience for future generations.

For more information about the Forever Arnolds Park Society, please contact Denny Walker 402-6880-2100.

Gift Vehicles for Planned Gifts

Bequests

Bequests are the most common form of planned gift provided. With the aid of your attorney, you may include bequest language in your last will and testament that directs a specific asset, total dollar amount or percentage of your residual estate to be given to Arnolds Park Amusement Park. Your bequest may also include instructions for the use of your gift, such as a specific area or program of benefit. Undesignated bequests are directed to the Arnolds Park Endowment Fund.

Retirement Plan Assets

Qualified retirement plans make an excellent asset for charitable giving as they represent one of the most tax-burdened components of any portfolio. By naming Arnolds Park as a beneficiary of your Traditional or Roth IRA, 401(k), Keough, SEP, or other qualified retirement plan, you can avoid substantial tax liabilities that may come into play when used as an inherited asset.

Life Insurance

Donors may contribute a life insurance policy or name Arnolds Park Amusement Park as the policy’s beneficiary. Policies that are paid in-full, or partially paid, may be transferred to the Park. The donor is responsible to continue premium payments for partially paid-up policies, and those payments may qualify for tax deductibility.

Sample Bequest Language

To secure the future of Historic Arnolds Park and its initiatives, HAPI has established the Forever Arnolds Park Society to continue to nurture and support the Historic Arnolds Park mission, now and in the future. Your legacy gift will help ensure that we will continue to operate the amusement park safely and responsibly while providing exceptional service and a clean and friendly experience, while protecting the environment, preserving the history and promoting family fun for all ages.

The following is sample bequest language for use when including Arnolds Park Amusement Park as a beneficiary of your final plans. These examples are provided for clarification purposes only and should not be construed as legal advice. We encourage you to speak with your legal or financial advisor if you are considering a planned gift.

Sample Language for Will or Revocable Trust – Dollar Amount

I give ________ dollars to Historic Arnolds Park, Inc., Arnolds Park, Iowa, free of trust, to be used as directed by the organization’s Board of Directors.

Sample Language for Will – Percent of Residuary Estate

I give ________ percent of my residuary estate to Historic Arnolds Park, Inc., Arnolds Park, Iowa, free of trust, to be used as directed by the organization’s Board of Directors.

Sample Language for Revocable Trust – Percent of Trust Property

I give ________ percent of my remaining trust property to Historic Arnolds Park, Inc., Arnolds Park, Iowa, free of trust, to be used as directed by the organization’s Board of Directors.